About this money earning :

What are u going to tell ?

Team Life Care (TLC) company is partner channel with Bajaj Allianz Insurance company in India. For every person his/her life is more precious than anything else. So every one will have minimum one policy.

Here comes the question, from which insurance company, need to take. There might be many, but I going to suggest Bajaj Insurance company (yourself check which is the best, then u easily accept). Taking the policy through TLC channel partner, you will become TLC coordinator. Thus you will enter & a place is provided in BIG MONEY TREE.

Either with your own interest if you refer some persons to TLC or not, this TREE keeps on growing…no limit. Who ever joins later becomes under you. So you will get money & use to get this money as long as this TREE grows & under persons pays the premium amount!!!!

So this is what iam telling...Simple.

About Bajaj Allianz Insurance

In 2000, under GATT ACT (globalization) many GLOBAL ECONOMIC sectors entered India

Allianz is a German based INSURANCE company established in 1890. It is one of the LARGEST insurance company: Covering 70 counties for both Life & General, Covering 7 wonders of the world, Managing 58, 92,000 crores assets & leading stock corporations sectors. It cleared the insurance coverage for WORLD TRADE CENTRE, US in no time when attacked in Sept 11 2001.

Allianz is a German based INSURANCE company established in 1890. It is one of the LARGEST insurance company: Covering 70 counties for both Life & General, Covering 7 wonders of the world, Managing 58, 92,000 crores assets & leading stock corporations sectors. It cleared the insurance coverage for WORLD TRADE CENTRE, US in no time when attacked in Sept 11 2001.

By registering under IRDA (Insurance Regulatory and Development Authority , India

Bajaj Allianz Life Insurance Company Limited and 02.05.2001 as Bajaj Allianz General Insurance Company Limited.

About Team Life Care (TLC) Company:

Team Life Care is one of leading private sector channel partners of Bajaj Allianz Life Insurance Company which is a part of two leading conglomerates, Bajaj Group the biggest 2 & 3 wheeler manufacturers in the world and Allianz AG one of the world’s largest insurance companies.

In 2002 Team Life Care Company started its operations in Salem. In 2003 the company got its IRDA authorization to partner with Bajaj Allianz and market their Life Insurance Products.

Team Life Care is one of leading private sector channel partners of Bajaj Allianz Life Insurance Company which is a part of two leading conglomerates, Bajaj Group the biggest 2 & 3 wheeler manufacturers in the world and Allianz AG one of the world’s largest insurance companies.

In 2002 Team Life Care Company started its operations in Salem. In 2003 the company got its IRDA authorization to partner with Bajaj Allianz and market their Life Insurance Products.

Come and Join & Be a Bajaj Allianz Insured Person & bless with God HAND (Hand = Five Benefits)

From Bajaj Allianz Company

1. Insurance Policy

2. Multiply your amount in share market

2. Multiply your amount in share market

How ??

Every policy holder under TLC channel partner will be considered as TLC co-ordinator & under TLC BIG TREE, some where u will be joined (under the person who introduced to TLC).

After this you have two options

a. Being an active TLC co-ordinator, aim to achieve levels & their benefits atleast by introducing your own family/friends to this group.

b. Being a passive person, just maintain your policy by paying the premiums.

Whether you are an ACTIVE / PASSIVE Person, for every insurance being made under you, you will get Rs.900/- and less than this amount for every premium made by that policy holder till that policy matures. This is referred as INCENTIVES salary for every month from TLC to their Co-ordinators. Just imagine, if every member under you starts introducing policies, means it becomes CONSTANT income source for every month. Not only this, will have OFFERS & ACHIEVEMENTs regularly (like, electronic widgets, silver, gold, cars, trips etc.,)

TLC has been considered as BEST policy channel among all other policies channels ( like LIC, ICICI etc) – Mainly because, If a person gets 10L income for every year means, then no need to worry about the TAX J . TLC gives FORM 16 to every co – coordinator. Due to this mainly, all GOVT & Central employees and business peoples were @ front level to convert their BLACK money into WHITE money.

In Global Market, we too have such schemes in retail marketing – Amway, Health sector - Herbal Life etc.

But the main difference is that: Those are expense + incomes; means need to spend money in order to get incomes. So only usage is FREE there. But in TLC, policy investment + incomes… + income … à no expense, only invest & income.

But the main difference is that: Those are expense + incomes; means need to spend money in order to get incomes. So only usage is FREE there. But in TLC, policy investment + incomes… + income … à no expense, only invest & income.

Hey tell me ...in detail !!!!

From Bajaj Allianz Company

Many linked policies exist from Bajaj. The policies are: Invest plus Premier, Shield Plus, Assured Gain, Family Care first, Fammily Assure II, Super Saver. One of which is explained as below.

(For other policies, visit the link - http://www.teamlifecare.in/products OR http://www.bajajallianz.com/Corp/life/unitlink.html )

Policy: New Unit Gain

Tax: 80C applicable

Tax: 80C applicable

Premium: Min 25,000 – Max No limit (6,500 is the lowest)

Sum Assured: 2 to 4 L

Term: Min 3 yrs – Max 20 yrs

Accidental: 4- 8 L

Sum Assured: 2 to 4 L

Term: Min 3 yrs – Max 20 yrs

Accidental: 4- 8 L

Age: Min 0 yrs – Max 55 yrs

Medical: 50,000 – 1 L

Fund types: Asset Allocation * No tax deduction while taking final fund

Equity Index II & Growth ** Partial withdraw Option

Midcap, Bond & Liquid

FUND Value: ~2.5 L after 6.3 years

Medical: 50,000 – 1 L

Fund types: Asset Allocation * No tax deduction while taking final fund

Equity Index II & Growth ** Partial withdraw Option

Midcap, Bond & Liquid

FUND Value: ~2.5 L after 6.3 years

2. Multiply your amount in share market ( will help u to do this)

We, our own circle of TLC co-ordinators, were grouped as TEAM (includes persons from various backgrounds). With deep involvement in investment & sharing sectors, we will help our

sub coordinators to avail the benefits of these unit linked policies. Like switching the funding, taking the madcap partial amount etc…as & when sharing market waves economically.

From Team Life Insurance Company

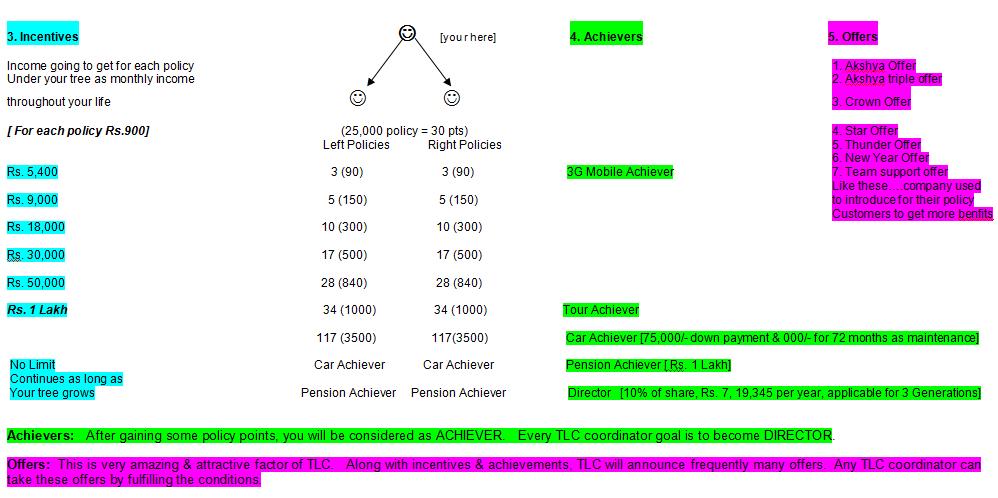

About the below incentives: For every 25,000 policy, policy holder will get 30 points. New policy holder can join the TREE, either as a LEFT child or RIGHT child. Likewise, the TREE grows. As TREE grow, every individual policy holder also GROWS.

EX: If 3 policies (A person can have any number of policies) with 90 points on LEFT side and 3 policies with 90 points on RIGHT side means, the MAIN policy holder will get 3G mobile worth of 15k and incentives Rs. 5,400.

See the below to know benefits from company - 3. Incentives, 4. Achievers, 5. Offers

So what i have to do ??

Very Simple....

Take Bajaj Allianz life insurance policy & first insure to your LIFE. Then refer some policies from your friends or relatives etc.,

Then Automatically TREE will grow & you will get income.

For more these kind of questions please check the FAQ page.